An often-ignored variation of identity theft has substantially gained popularity over the last decade – child identity theft. Child identity theft occurs when the social security number or other personal identifiers of a minor child are used by another person for the imposter’s personal gain.

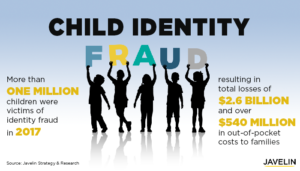

Citing a 2018 Child Identity Fraud Study by Javelin Strategy & Research, more than 1 million children were victims of identity fraud last year; two-thirds were under the age of eight. Resulting losses were $2.67 billion, with families incurring over 540 million in out-of-pocket expenses Minors who were bullied online were nine times more likely to become victims of fraud than minors who were not bullied.

In 2003, the Federal Trade Commission reported only 6,500 cases of child identity theft.

Minor children are often easy targets of identity fraud as thieves typically get an eight to ten-year head start on them. In fact, most minor children are not aware of an identity theft issue until they someday apply for a passport, driver license or state identification card, higher education and student loans, a credit card, employment or the military.

Parents or custodial relatives are usually the first to notice that something is not quite right. Discovery of child identity fraud often comes:

- When attempting to open a checking/savings account or higher education fund for the minor child. In this scenario, a parent or custodial relative learns that an account with that social security number already exists or that a new account is denied due to prior worthless checks on file at Chex Systems;

- When pre-approved credit card offers arrive in the mail bearing the name of the minor child;

- When credit cards, checks, invoices or bank statements not opened by the minor child are received in the mail;

- When debt collection agencies call and/or send demand letters about accounts not opened by the minor child;

- When a minor child is denied a passport, driver’s license or state identification card because another individual has obtained one using their social security number. The imposter may even have accumulated civil or criminal traffic citations in their name;

- While preparing for a divorce or child custody proceeding an unoffending parent learns of the theft of a minor child’s personal identifiers by the other parent;

- When a law enforcement officer or process server knocks at the door with a warrant for the arrest of your minor child or a summons indicating the start of civil litigation.

According to the Child Identity Fraud Study by Javelin Strategy & Research, some of these child identity theft cases involve split families where one of the parents is the perpetrator and the crime is exposed by the other, unoffending parent. In fact, 22 percent of child identity fraud cases are committed by a parent or step-parent while 10 percent of cases are perpetrated by other relatives, including siblings, aunts, uncles and cousins. The most common perpetrators of child identity theft are family and friends.

“As a victim of identity theft myself, I welcome the ability to lock my child’s personal identifers from unlawful use,” Xavier Mitjavila Moix told the South Florida Reporter. “In the past, the credit bureaus made it difficult to perform this simple task.”

Place an Equifax child credit freeze – Experian child credit freeze – TransUnion child credit freeze.

A common misconception of most parents is that creditors and credit reporting agencies have a verification method when it comes to the age and identity of a minor child applicant. Since most creditors rely solely upon the written application when rendering a credit granting decision and the age of an individual becomes “official” with the credit reporting agencies of Equifax, Experian and TransUnion upon the first application for credit, said reliance can be detrimental when it comes to child identity theft issues.

There are some instances that appear to be child identity theft but are not. Receiving a single pre-approved credit card offer in your minor child’s name might upset you as a parent. However, it might only be an innocent marketing tool sent by a potential creditor because you opened a higher education fund for your minor child. A quick check of credit reports at the respective credit reporting agencies will sort out the truth. Currently, all three credit reporting agencies have automated request systems. You should contact them annually to request a credit report on your children. If you are advised that no file exists, your minor child is safe and you should lock or otherwise freeze their social security number from use.

Contact Equifax at (800) 685-1111; Experian at (888) 397-3742; and TransUnion at (800) 916-8800.

If your minor child is the victim of identity theft, file a police report with your local law enforcement agency immediately. Federal law mandates that the Equifax, Experian and TransUnion credit reporting agencies investigate and correct all identity theft issues, but only with verifiable reporting of a crime. Without the police report and a fully executed FTC Identity Theft Affidavit, creditors and credit reporting agencies are not required to act upon your complaint.