At the start of 2024, many renters are exploring new housing options that better align with their budgets amid inflation, interest rates, home prices and costs of living.

The Sunbelt states — known for their warm climates and business-friendly environments — have traditionally attracted a large number of renters, including a notable preference for Miami, the #1 rental market. However, in the early months of 2024, the Midwest gained more appeal, securing seven spots among the nation’s top 20 hottest rental markets. Quite far behind, the Northeast and Florida each made their mark with four spots in the top 20.

The Midwest has emerged as the most competitive region for renting at the start of 2024 primarily due to its affordability and reinvented economy, which is attracting high demand for rental properties. As a matter of fact, in addition to its cost-effectiveness, today’s Midwest has almost completely shaken off the old “Rust Belt” label. Rather, most of the big metro areas here are buzzing with activity in the tech and manufacturing scenes, thanks to growing sectors like automotive, aerospace and renewable energy.

Similarly, renting in the Midwest is a good choice for many aspiring homeowners, including longtime residents and newcomers. That’s because this housing arrangement allows them to save up for down payments until they’re able to fulfill the American dream of owning a home. To that end, Milwaukee has become the nation’s second-hottest renting spot in the first months of 2024 and is leading the charge in the Midwest.

To find the most competitive rental markets in the U.S. at the start of the year, RentCafe.com analyzed the 139 largest markets in the country where data was available. We used five relevant metrics in terms of rental competitiveness:

- the number of days apartments were vacant

- the percentage of apartments that were occupied by renters

- the number of prospective renters competing for an apartment

- the percentage of renters who renewed their leases

- the share of new apartments completed recently

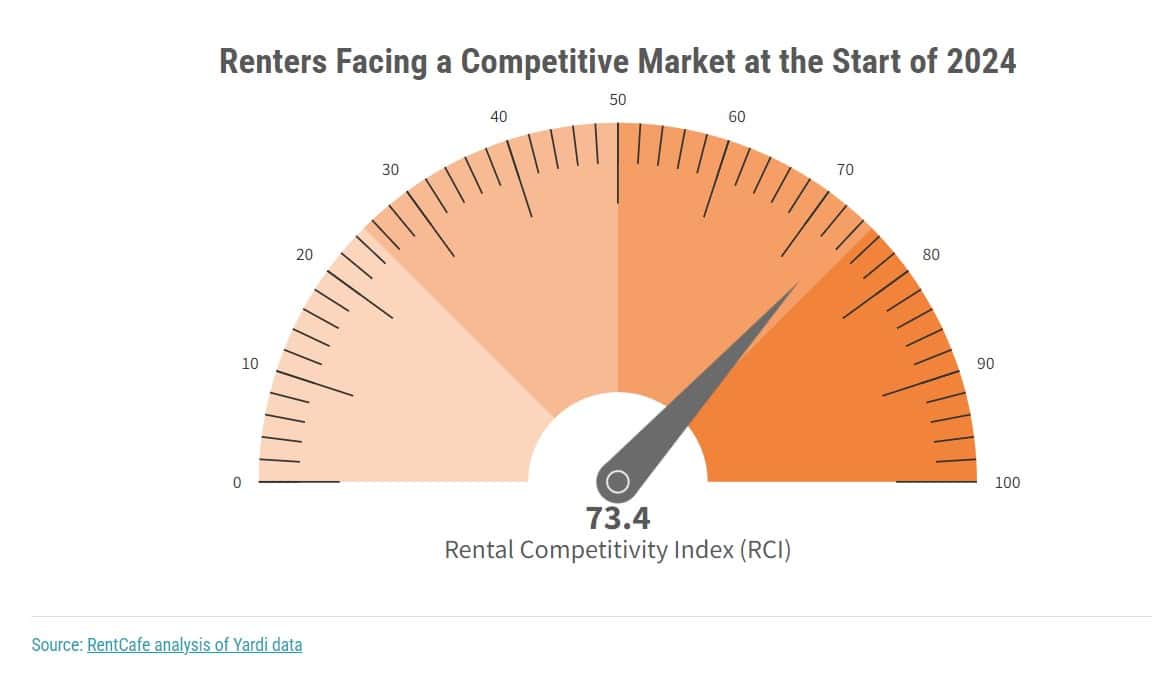

Then, to measure the competitiveness of the rental market as the year was unfolding, we calculated a Rental Competitiveness Index (RCI). Specifically, at the start of 2024, the national RCI score was 73.4, indicating a moderately competitive rental market.

The number of days until vacant apartments are occupied increases in most markets

Unsurprisingly, some key metrics considered in this report continued to be affected by the slew of new apartments that were opened during the last three years. This means that the U.S. rental market is more relaxed at the start of 2024 than it was one year prior.

The most noticeable change is the increase in the number of days it takes to fill an average apartment. More precisely, vacant apartments now stay empty for 41 days (compared to 38 days at the start of 2023) as the newly built apartments make up 0.67% of the total housing supply. By comparison, one year ago, new units accounted for only 0.43% of all rental apartments in the U.S.

Naturally, this caused a drop in the U.S. occupancy rate, which is 93% in early 2024, down from 94.2% a year ago. Furthermore, because it’s the off-rental season — and even though they have more choices to choose from— more apartment-dwellers chose not to move in the first months of 2024. This led to an overall lease renewal rate of 61.5%, which is higher than the 60.7% share of lease renewals at the start of 2023.

Moreover, 61% of the 66 large markets we analyzed in this report are less competitive than they were at the end of 2023. Likewise, competition is less intense in about 47% of the 73 small markets we looked at compared to the last quarter of 2023. The most common trend is an increase in the number of days that empty apartments stay on the market.

Miami’s apartment market continues to sizzle, outshining Florida’s waning appeal

Boasting an RCI score of 91.9, Miami reaffirms its position as the most competitive rental market in the U.S. at the start of the year. Here, its thriving economy — fueled by tourism, finance, technology and international trade — ensures a steady demand for apartments. Accordingly, job opportunities abound, thereby attracting many professionals who often opt to rent initially, which further boosts the competition for rental properties. Plus, the city’s laid-back lifestyle, desirable location and pleasant weather only add to its allure, attracting tourists year-round and putting more pressure on its supply of apartments.

That said, it takes 36 days for a vacant apartment in Miami to be filled, and a whopping 14 renters are competing for each unit — the highest in the country, only matched by vacant apartments in Worcester-Springfield, MA. What's more, only 3.5% of its rental units were available for apartment seekers, especially as the share of newly built apartments only accounted for 0.97% at the start of 2024, down from 1.24% one year prior. Under these tight circumstances, almost three-quarters (73.4%) of those already renting in Miami stayed put in the first months of 2024.

Next up, Milwaukee shines as the second hottest rental market at the start of 2024, with an RCI score of 87. With a flourishing job market and an affordable cost of living that only adds to its appeal, the metro presents attractive housing opportunities for renters, especially in coveted areas near major employers. At the same time, urban revitalization initiatives — including Raze and Revive — breathe new life into neighborhoods, attracting young professionals seeking an urban lifestyle.

This mix of high appeal and insufficient apartments (the share of recently built rentals accounts for 0.53% of all apartments for rent in the metro) led to 72.3% of renters in Milwaukee renewing their leases in the first months of 2024. As a result, this pushed the occupancy rate to 95.1%, which is significantly higher than the national average. Meanwhile, vacant apartments were filled within 37 days, on average, with nine applicants competing for each available unit.

Interestingly, although there are fewer prospective renters vying for each available unit (down by two since early 2023) and it takes one extra day for apartments to be occupied, Milwaukee’s rental market is slightly more competitive than it was one year ago. This is mainly because there aren’t as many options for renters to choose from in early 2024 as there were at the same time in 2023, when brand-new apartments accounted for 0.74% of the local supply of rentals.

Cost-effective Midwest claims one-third of the nation’s hottest rental markets

The Midwest offers relatively lower living costs compared to other regions, making it an attractive option for renters facing higher rents in other parts of the country. Additionally, the rise of remote work has led to an increased demand for larger living spaces in previously low-cost areas. Even so, the low inventory can’t keep up with the surge in demand for apartments, making the Midwest the toughest region to rent in the U.S. In fact, the Midwest emerged as the #1 most sought-after region for renting, with 12 of its cities dominating the list of places to watch in 2024.

Besides Milwaukee, another highly competitive rental market in the Midwest is Suburban Chicago, which secured fourth place in our ranking (RCI 85.3). With sought-after places such as Naperville, Crystal Lake, Joliet, Schaumburg and Elgin in Illinois — along with Hammond, Munster and Gary in Indiana — these suburban areas provide more budget-friendly housing options for renters. This includes remotely working Millennials and downsizing Baby Boomers in search of more space, better amenities and a quieter lifestyle outside of the bustling urban core.

Here, as well, the supply of apartments can’t keep up with high demand, and the share of brand-new rentals represents just 0.51% of all apartments for rent in the suburbs of Chicago. As such, more than two-thirds (68.2%) of the existing renters renewed their leases in the first months of the year, resulting in an occupancy rate of 95% across Suburban Chicago. For this reason, there are 10 renters vying for each vacant unit and available apartments typically fly off the shelves within 37 days.

Next up is Grand Rapids, MI, emerging as the fifth most competitive rental market at the start of 2024 (RCI score 84.5). With its enticing blend of low unemployment and a cost of living that won’t break the bank, Grand Rapids continues to attract many students and young professionals eager to grow their careers in key sectors such as healthcare, manufacturing and education, thereby boosting the demand for apartments.

However, due to insufficient new apartments in the area, the lease renewal rate in the Grand Rapids metro area amounted to a staggering 76.6% in the first months of 2024 — only surpassed by Central Jersey (#26 in our ranking), at 79.9% — driving the occupancy rate to 95.1%. Furthermore, there are six prospective renters competing for each available apartment, which is occupied within 39 days, on average.

Other large markets in the Midwest in our top 20 for rental competitivity at the start of 2024 are Cincinnati (#8, RCI score 82.4); Lansing-Ann Arbor, MI (#9, RCI score 82.3); Omaha, NE (#13, RCI score 79.9); and Kansas City, KS (#16, RCI score 78.5).

North Jersey leads the charge in the Northeast amid insufficient apartments in the region

While the Midwest dominates our ranking at the start of 2024, the Northeast is also experiencing intense competition. In this case, this is mostly fueled by the lack of available apartments amid surging demand as the high cost of homeownership in the region has made renting a more attractive option for many people, both longtime residents and newcomers.

For instance, finding an apartment in North Jersey remains challenging, but there is a slight softening in the market from its peak as the nation's most competitive renting hub one year ago. To that point, North Jersey is the nation’s third hottest market for renting at the start of 2024, with an RCI score of 85.4. This metro area mostly includes places right across the river from Manhattan like Jersey City, Hoboken and Union City, NJ, where renters get more bang for their buck while still being very close to the Big Apple, as well as more distant New Jersey locales such as Newark, Lyndhurst and Orange.

Overall, the share of new apartments accounts for a modest 0.51% of the rental units in these locations, which explains the high occupancy rate of just less than 96% amid a lease renewal rate of 73.1% at the start of the year. Plus, with nine eager renters vying for each available unit, vacant apartments in North Jersey stay on the market for 38 days, on average.

Ranked 12th nationwide and third in the Northeast, Brooklyn, NY, (RCI score 80.5) is a competitive rental market, especially for those who love the thrill of New York City but who are also in search of better housing options.

Yet, the supply of rental apartments in Brooklyn fails to keep up with demand, as newly built units account for a mere 0.19% of the borough’s housing stock. This led to a lease renewal rate of 68.9% at the start of 2024, pushing the occupancy rate to a high 96.1%. Consequently, the average vacant apartment is filled within 39 days here, with five applicants vying for each available unit.

Silicon Valley rentals disappear in just 5 weeks as more techies head back to their offices

Orange County (#11 nationally and #1 in California) is slightly more competitive than it was one year ago. Even with a 0.59% uptick in newly built apartments, the area’s lease renewal rate stands at 60.1% at the start of 2024 amid a high vacancy rate of 96.2%.

Meanwhile, over in San Diego (#18 nationally and #2 in California), only half of those already renting in the metro renewed their leases and apartments were filled two days faster than in Orange County (38 days vs. 40 days, on average).

Further north — and rounding out our top 20 most competitive rental markets at the start of 2024 — is tech-driven Silicon Valley. Here, hybrid work and return-to-office policies have led to increased demand amid very limited supply of rentals in places like Mountain View, Cupertino, Menlo Park, San Jose, Sunnyvale, Redwood City and Palo Alto in California.

In fact, the area has seen zero new apartments opened recently, which prompted almost half of the existing renters to stay put at the start of the year. As a result, available apartments here get snatched up the fastest in all of California (most often within 37 days) with nine eager renters competing for each vacant unit.

Small college towns are buzzing rental hotspots, with Fayetteville, AR, leading the charge

Many small markets across the U.S. are seeing fierce competition spurred by the soaring costs of living and housing in major cities, along with the advent of remote work. At the same time, the skyrocketing demand from students and faculty staff only adds fuel to the fire in these undersupplied places. Take Fayetteville, AR, for example: Here, the University of Arkansas broke its enrollment record for the third year in a row, welcoming more than 32,000 students for the fall semester of 2023.

Accordingly, Fayetteville emerged as the hottest small rental market in the U.S. at the start of 2024 (RCI score 88.1). Vacant apartments in the area often fly off the shelves after just 22 days — almost three weeks faster than the national average — with six applicants vying for each vacant unit.

Plus, almost three-quarters of the current renters in Fayetteville renewed their leases rather than moving out in the first months of the year, especially as the share of newly built apartments only amounted to 0.3% of the total supply of housing. That pushed the occupancy rate in Fayetteville to 95.1% in early 2024, significantly below the national benchmark.

Next up, Lafayette, IN, emerged as the second-most competitive rental market at the start of the year (RCI score 87.5). Besides the growing local economy, Purdue University's influence in the area is a major driver for the rental market, attracting a vast number of students — including a significant international cohort — and faculty members seeking housing here.

Here again, with zero new apartments built recently, securing a new rental place in this Midwest city is a real challenge: The lease renewal rate stands at 68.4% and a staggering 96.9% of all rental apartments in the area were occupied at the start of 2024. Typically, each apartment sees competition from 11 prospective tenants and is snatched up within a month.

Coming in third is Lehigh Valley, PA, (RCI score 85.8) home to several colleges and universities that contribute to the area’s economy and provide plenty of opportunities in quaint, history-rich towns like Allentown, Easton and Bethlehem. However, apartment-hunters in Lehigh Valley are up against fierce competition due to a shortage in available rentals, despite a modest 07% uptick in recently built units.

So, with a stark lack of housing, those in search of apartments in Lehigh Valley faced a high occupancy rate of 96.1%, while more than 80% of existing renters decided to stay put in the early months of 2024. Consequently, each vacant unit attracted 10 eager applicants, and apartments were typically leased within 37 days.

The start of 2024 sees intense competition in small renting spots scattered throughout the Midwest

Notably, the Midwest boasts seven entries among the top 20 most competitive small rental markets, highlighting the region’s growing appeal for renters. In fact, it emerged as the top region to watch in 2024 based on apartment hunters’ growing appetite for rentals here during the previous year.

Besides Lafayette, Madison, WI, stands out as another top contender for renters in the Midwest after securing the sixth position among small rental markets. Despite local developers ramping up efforts to launch new apartments across the metro (contributing to 1% of the housing stock), Madison falls short of quenching the thirst for rentals. Thus, each vacant unit in Madison drew in 13 hopeful renters amid an occupancy rate of 96.1%. Moreover, vacant apartments for rent in Madison were filled within just one month, on average, at the start of the year.

Other small markets that are highly competitive in the early months of 2024 include Knoxville, TN (#4, RCI score 85.6); Harrisburg, PA (#5, RCI score 85); Little Rock, AR; Providence, RI; Worcester-Springfield, MA; Tulsa, OK; Palm Beach County, FL; Youngstown, OH; Portland, ME; Wichita, KS; Buffalo, NY; Dayton, OH; Rochester, NY; North Dakota; South Bend, IN; and Asheville, NC.

Browse the maps below to see the rental competitivity in other regions in early 2024:

Source: News Release

Methodology

RentCafe.com is a nationwide apartment search website that enables renters to easily find apartments and houses for rent throughout the U.S.

To compile this report, RentCafe.com’s research team analyzed Yardi Systems apartment data across 139 rental markets in the U.S. The data comes directly from market-rate large-scale multifamily properties of at least 50 units. Fully affordable multifamily properties were excluded.

The markets were ranked based on a market competitive score. To calculate each market’s score, we ranked them according to five metrics and their averages for October through December 2023: apartment occupancy rate; average total days vacant; prospective renters per vacant unit; renewal lease rate and share of new apartments completed during the same timeframe compared to the existing overall supply at the start of Q4 2023.

We then compiled an average ranking by assigning a percentage weight for each metric: 30% for apartment occupancy rate; 15% for average vacant days; 15% for prospective renters per vacant unit; 30% for renewal lease rate; and 10% for the share of new apartments.

In this study, the terms “market,”, “area”, “metro” and “location” are used interchangeably and are as defined by Yardi Matrix markets.