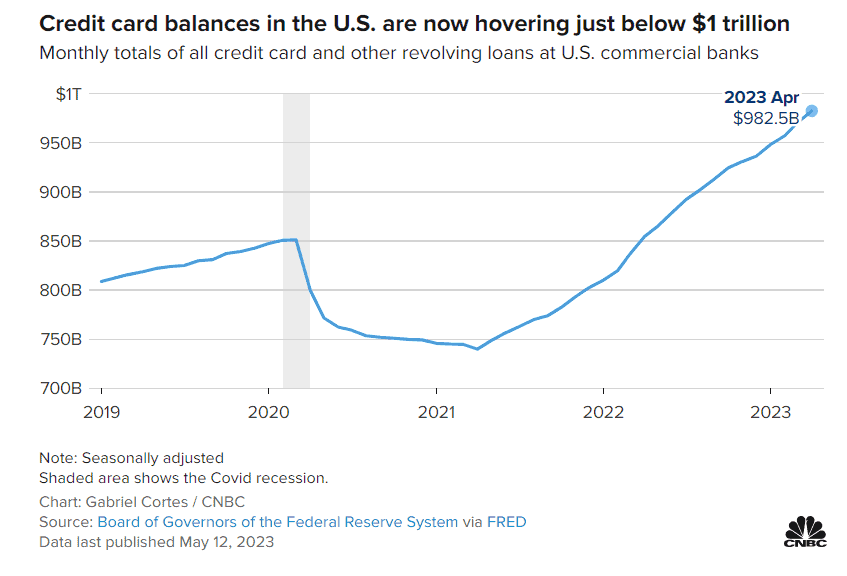

The federal debt ceiling stalemate underscores the need for urgent spending reform. U.S. households are in a similar predicament — after running up record credit card balances.

In the first quarter of 2023, total consumer debt hit a fresh high of just over $17 trillion, according to a recent report on household debt from the Federal Reserve Bank of New York. Credit card balances alone now total $986 billion.

“Unfortunately, it’s going to crash and burn for a lot of families because families can’t artificially raise their debt ceiling.”

How to know if you face your own debt default

After contending with high inflation for over a year, households are nearing a “breaking point,” according to a study by WalletHub.

Using the Great Recession as a guide, the projected breaking point is the level of household credit card debt that will become unsustainable for most people, said Jill Gonzalez, an analyst at WalletHub. Currently, the average household’s credit card balance is $9,990, just $2,015 shy of where that tab hits its limit, the report found.

More than one-third also now have more credit card debt than emergency savings, which is the highest on record.

‘It’s never too late to turn things around”

As government negotiations over potential federal spending cuts continue, households must also consider where they can cut costs and boost savings.

“It’s never too late to turn things around,” Rossman said.

Most experts recommend starting with a budget — some online tools or the basic envelope method, known as “cash stuffing,” can help — and aiming to set more money aside in an emergency fund, which can shield you from accumulating more debt while you’re working to pay off your existing balance.

After years of rock-bottom returns, some top-yielding online savings accounts and one-year certificates of deposit rates are now as high as 5%, much higher than the average rate from a traditional, brick-and-mortar bank, according to Bankrate.

“I call it ‘click and mortar,’” Jenkin said. “The easiest thing to do is simply call the bank and demand a higher interest rate or look at moving money out of your checking account into a savings account.”

This article originally appeared here and was republished with permission.