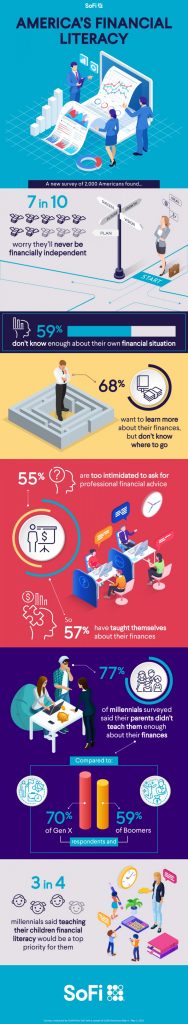

Seven in 10 Americans worry they will never be financially independent, according to new research.

The study asked 2,000 Americans about their finances and how knowledgeable they feel on the subject.

Fifty-nine percent of respondents said they don’t know enough about their own financial situation today.

Conducted by OnePoll on behalf of SoFi, the survey also found that 68% of respondents want to learn more about their finances, but don’t know where to go.

More than eight in 10 respondents said they believe that high schools should be required to teach financial literacy.

Another 55% of those surveyed said they’re too intimidated to ask for professional financial advice.

So in order to learn more, 57% have tried to teach themselves about their finances.

The top thing respondents had to teach themselves was how to pay their taxes, closely followed by learning about how credit card interest works.

Perhaps this is all connected to how mom and dad handled their finances back in the day – as 72% of respondents said they felt their parents didn’t teach them enough about their finances.

Are the days of passing your financial skills to your children come and gone? The results showed the younger the respondent, the less likely their parents gave them “the talk” about their finances.

Three-quarters of millennial respondents also said that teaching their children financial literacy would be a top priority for them.

Another trend that varied by age, was respondents’ reactions to the 2008 financial crisis.

Eighty-two percent of millennials polled said the recession was a wake-up call for them to handle their finances better, compared to 77% of Gen X respondents and 58% of Baby Boomers surveyed.

Looking at their current financial situations, seven in 10 respondents worry they’ll never be able to be financially stable.

Sixty-five percent of those surveyed said this worry was connected to the ever-increasing costs of college tuition – with millennial respondents in the most agreement at 71%, compared to 66% of Gen X respondents and only 36% of Baby Boomer respondents.

“SoFi is on a mission to help people achieve financial independence by getting their money right. The results of this survey really underscore the importance of that mission and of developing a right-sized financial plan across your saving, spending, borrowing, and investing objectives,” said Anthony Noto, CEO of SoFi.

With all these worries, it’s no surprise that 58% of those surveyed said they feel they don’t have control over their financial affairs.

Six in 10 respondents also agreed that keeping track of their finances is stressful.

“We know that money is stressful. That’s why we provide our members with many of the tools they need as well as access to complimentary financial planning services so that they know how to take an active role in planning their financial futures,” added Noto.

TOP FINANCIAL LESSONS AMERICANS TEACH THEMSELVES

- How to do taxes 42%

- How credit card interest works 37%

- How to apply for a car loan 36%

- How to apply for a personal loan 36%

- How to make a monthly budget 35%

- How to apply for a mortgage loan 34%

- How to invest 33%

- How to create a savings account 33%

- How to create a checking account 33%

- How to apply for a student loan 32%

- When to save for retirement 28%

- How the stock market works 27%

- The difference between stocks and bonds 27%

- How to create an emergency fund 27%

- What a 401K is 23%

- How to refinance a loan 23%