There are plenty of different ways to invest, and which one is ‘best’ will depend upon the individual investor’s personal situation. There has been one particular investing strategy that has afforded investors upside participation when markets are rising, modest downside protection when markets are falling, and steady dividend income throughout, making it a winning strategy over the long run.

This strategy is to invest in the best dividend stocks, like the Dividend Aristocrats as an example, and reinvest the dividends. Indeed, these are also known as blue chip stocks. Over time, this strategy allows for investors to generate income, which rises over time and receive a measure of volatility protection during market downturns.

The Dividend Aristocrats represent some of the most resilient and time-tested businesses, and investing in the best dividend stocks has many benefits.

Generating Long-Term Wealth

Over long periods in market history, dividend stocks have reigned supreme over those that don’t pay dividends. Part of this is because of the tangible and obvious benefit of the stocks paying investors cash to hold them; this income helps boost total returns, all else equal. But in addition to that, the best dividend-paying stocks tend to be extremely resilient and profitable businesses under just about any kind of economic climate. This means profits move higher under most circumstances, and thus, the share price follows.

In the case of the Dividend Aristocrats, in order for a stock to make it into this prestigious index, it has to be a member of the S&P 500, meet certain size and liquidity requirements, and have a dividend increase streak of at least 25 years. A 25-year dividend increase streak means that any company in this list is able to not only pay its dividend during recessions but also raise it. That means that the company’s earnings and cash flows can support a rising payout irrespective of the economic climate, which means the stock is likely to hold up much better during such events than a stock that doesn’t pay a dividend. That helps with volatility during tough market periods, but it also provides the benefit of income, even when the going gets tough.

Importantly, great dividend stocks have management teams that are not only able to pay dividends during all kinds of market climates, but the willingness to do so. There are many stocks today with plenty of earnings and free cash flow that choose instead to focus on investing in future growth rather than returning cash to shareholders. The best dividend stocks have management teams that understand the importance of dividends and are willing to defend the dividend no matter what.

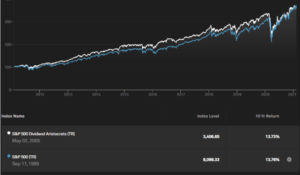

One way we can see the relative performance of Dividend Aristocrats, as a proxy for dividend stocks in general, is to plot it against the benchmark. The S&P 500 index itself contains many dividend-paying stocks. For context, the S&P 500 contains just over 500 stocks, as some companies have more than one listed ticker, while the Dividend Aristocrats contains just 65 stocks. The exclusivity of the Dividend Aristocrats gives investors an idea of just how difficult it is for a company to raise its dividend for at least 25 consecutive years.

This chart shows the Dividend Aristocrats index with the white line above, and the benchmark S&P 500 in blue. What is plotted is total returns, which includes dividends. We can see that prior to the COVID-driven selloff in early-2020, the Dividend Aristocrats outperformed the benchmark for many years, and in some cases, by very wide margins. Part of these returns were driven by the prevailing interest rate environment during this time, as falling interest rates makes income securities relatively more valuable. However, even with this being the case, the Dividend Aristocrats showed tremendous outperformance against the S&P 500 for nearly all of the past decade.

In the past year or so, soaring valuations of growth stocks has taken the S&P 500 very slightly ahead of the Dividend Aristocrats, but this happens from time to time. When we are looking at investing in dividend stocks, doing so for the long-term is the best approach, and over the long-term, dividend stocks are the winners in more ways than one.

Related read: How to Invest in Stocks

Dividend vs Non-Dividend Total Returns

Let’s now turn our attention to how powerful the impact of dividends is on total returns over time. After all, one of the major benefits of owning high-quality dividend stocks over time is that it provides the extra boost of total returns that is achieved via receiving dividend income.

Below is an example of how dividends add to total returns over time. This example uses the S&P High Yield Dividend Aristocrats index as the subject, which is a slightly different way to view great dividend stocks than the standard Dividend Aristocrats. However, the principal is exactly the same; owning dividend stocks helps boost total returns over time.

With total returns indexed to 100 at the beginning of this century, we can see that the total price return for this index is less than half of the total return when dividends are included. This is a terrific way to isolate the impact of receiving dividends versus not receiving them as this is a comparison of a dividend stock index against itself, and shows just the difference of receiving dividend payments versus not receiving them. If you own high-quality dividend stocks, your total return could certainly look like this over a long period of time, which is why investing in the best dividend stocks can help investors build significant wealth over many years.

In addition to this, high-quality dividend stocks tend to offer investors upside participation during periods of strong market rallies, while also offering some extent of downside protection when the stock market is declining.

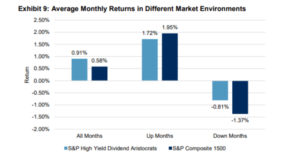

The below comparison shows the average monthly returns of the S&P High Yield Dividend Aristocrats versus the S&P 1500, which is a very broad market index that includes companies of all sizes, and is a good barometer of total market performance.

The results are striking, as the Up Months show very slight outperformance of the broader index, while the Down Months show that dividend stocks are much better insulated against selloffs. In total, dividend stocks strongly outperformed the broader market for this study, and while this certainly won’t be true for every market period, over time, this has held up for decades.

High-quality dividend stocks give investors access to very resilient and time-tested businesses, the tangible benefit of an income stream that can be spent or reinvested to generate even more wealth longer-term, and some protection during market downturns. This makes the Dividend Aristocrats and other lists of high-quality dividend stocks a great place for investors to start when it comes to finding their next purchase.

Now, let’s take a look at how to find the best dividend stocks.

Related read: How to Become Financially Independent

The Best Dividend Stocks

While the Dividend Aristocrats list is a terrific place to start the search for a new purchase, we can even further narrow down the candidates. For example, we can focus on companies with high yields, even longer dividend increase streaks, very high levels of dividend safety, recession resilience, and any number of other criteria an investor might use based upon their specific investing goals.

Thus, the ‘best’ dividend stocks for any particular investor may differ depending on whether that investor favors current yield, recession resilience, dividend growth, value, etc. However, for the best combination of these factors, below are two examples we like for long-term holders to generate strong returns and income simultaneously.

Related Read: How to Invest in Oil

First up is an example of a stock with an extremely high current yield, which certainly appeals to a wide variety of dividend stock investors. Having a high current yield provides not only the ability to generate strong income for spending purposes – for an investor that is already retired, for example – but it also provides investors that aren’t in that stage to reinvest significant dividend proceeds and generate even more income over time.

That stock is communications giant AT&T (T), a stock we like based upon its high 7% dividend yield and the value the stock represents. AT&T is not a growth stock, but as a utility provider, its earnings and cash flows are highly predictable, it holds up well during downturns, and as mentioned, its current yield is REIT-like at more than 7%.

Shares of AT&T have performed quite poorly in the past year, having fallen about 25% versus an 18% gain for the S&P 500 as a benchmark. While that isn’t ideal, periods of growth stock outperformance tend to leave dividend-focused stocks behind in terms of total returns. However, we see this as an opportunity for investors to own AT&T at a very reasonable valuation, with a sizable dividend yield.

The stock trades for just 9 times our earnings-per-share expectation for this year, which compares very favorably to our fair value estimate of 11 times earnings. That means we see AT&T as representing strong value in an extended market where value is difficult to find, and its 7.2% current yield is several times the broader market dividend yield of ~1.5%. Thus, for income-focused investors that want value from their dividend stocks, AT&T is hard to beat.

Growth is going to be somewhat difficult to come by for AT&T in the coming years, but we think the combination of the current yield and value proposition of the stock make for an attractive buy.

Another example of an attractive dividend stock, but for different reasons than AT&T, is real estate investment trust Federal Realty (FRT), a stock that has paid increasing dividends for more than half a century, putting it in extremely rare company by that metric.

Federal Realty has stood the test of time when it comes to weathering recessions and downturns in the real estate market to become one of the best dividend stocks in the market today. Like AT&T, Federal Realty has struggled in the past year, ceding nearly 30% over that time frame. However, this was due to the shock of COVID-19, and not a fundamental deterioration in the trust’s business model. The stock trades at about 19 times 2021 estimated FFO-per-share, which is below its recent valuations in the low-20s. The stock has the uncertainty of when the economy will be fully open and back to normal, but even still, the underperformance of the past year accounts for this, in our view.

With the 50+ year streak of dividend increases, investors get the peace of mind in knowing that they own a stock with a management team that values the payout above all else. The current yield of 4.6% is also very strong at about three times that of the broader market. In addition, we see FFO-per-share growth in the mid-single digits for the foreseeable future, which should afford Federal Realty not only a higher share price over time but the ability to continue to raise its dividend for the foreseeable future. The payout ratio is elevated for the moment because of the temporarily depressed FFO from COVID-19. However, we expect Federal Realty to have no trouble paying its dividend and raising it for many years to come.

Related read: How to Generate Income From a Portfolio

Final Thoughts

Finding the best dividend stocks, in our view, should begin with a list of the most tested, recession resilient stocks in the market, which one can find in the Dividend Aristocrats. Stocks like these provide investors with the ability to generate strong returns over the long-term with limited volatility, and current income. When proceeds are reinvested into high-quality dividend stocks, returns can be amplified even further. Over time, this compounding of wealth means investors can generate significant income with their dividend stocks to use to fund living expenses, or anything else. That’s why we believe that the best way to generate wealth for most investors, with limited volatility, is to use high-quality dividend stocks and hold for the long-term.