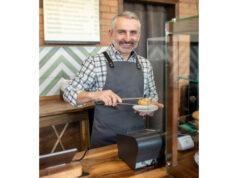

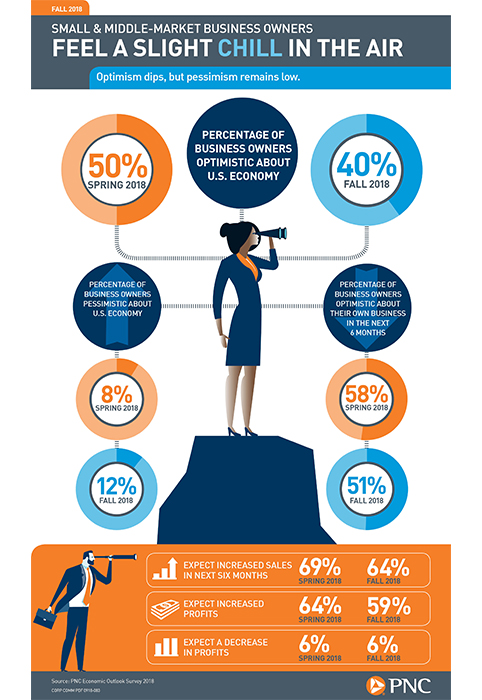

Historic optimism about the national economy from the spring (50%) chilled slightly this fall (40%), but remains well above fall 2017 (29%), according to PNC Bank’s semiannual survey of small and middle-market business owners and executives. Four out of 10 business leaders described their outlook for the national economy as optimistic, the second-highest rating in the 15-year survey. Continue reading below about the inforgraph

“Optimism for small and mid-sized business owners about the national economy, their local economies, and their own companies, remains near record highs, although it has slipped slightly since the spring, according to our fall 2018 survey,” said Gus Faucher, chief economist of The PNC Financial Services Group, Inc. “Hiring expectations also are near a record high, as we continue to witness the second-longest economic expansion in U.S. history.”

Nearly two-thirds (64%) of business leaders expect increased sales, dropping marginally from spring 2018 (69%). Expectations for increased profits are the second-highest on record (59%), only outpaced in spring 2018 (64%). Businesses anticipating a decrease in profits remains at a historic low (6%).

Key survey findings include:

Price Check: The number of business leaders forecasting rising prices in the next six months gained momentum. More than half (53% vs. 41% in fall 2017) anticipate suppliers charging more; 45 percent (vs. 29% in fall 2017) plan to charge their customers more. Of those planning to raise the prices they charge customers, (45%) anticipate a one- to two-percent hike, while 23 percent anticipate a five percent or more increase. Increasing business, favorable market conditions and rising labor costs are among the key drivers of higher pricing. Only three percent of businesses anticipate lowering prices.

Waging Workers: Small and mid-size business leaders expect wages and hiring to remain near the record highs reported in spring 2018. Forty-six percent expect to increase wages (vs. 49% in spring 2018), while the number planning to decrease workers’ wages remains at a survey low of two percent.

Bonus Round: With the labor market continuing to tighten, eight in 10 (82%) business leaders across all industry sectors say they already have taken one or more actions to retain existing or to attract new employees: increasing wages/salaries (44%), offering or increasing bonuses (24%), and boosting benefits (24%). Over one in four (28%) have allowed more flexible work arrangements and one in ten have relaxed hiring standards.

The Three Faces of Tariffs: Four out of 10 (41%) respondents report currently selling/buying items or services to/from other countries to some extent. The percentages are significantly higher for manufacturers (59%) and wholesalers/retailers (47%). However, only eight percent of all respondents characterize the volume of that trade as “large.” When asked to choose sides on increasing U.S. tariffs on other countries’ goods based upon what’s best for their own business, 41 percent are in support (33% in spring 2017) and 31 percent are opposed (32% in spring 2017); more than a quarter of business leaders (27%) are uncertain.

As a result, four out of 10 anticipate paying higher prices to suppliers. Three out of 10 business leaders (31%) expect to increase the prices they charge their customers should the United States impose increased tariffs on other countries’ goods, but nearly half (47%) expect no impact. Nearly half of business leaders (48%) do not expect any impact on company sales, with 18 percent anticipating increased sales. Only eight percent forecast decreased sales as a result of increased U.S. tariffs on goods from other countries.

Taxed Out: Familiarity with the impact of the federal Tax Cuts and Jobs Act of 2017 on business increased slightly to 32 percent (vs. 27% in spring 2018); 35 percent are familiar with the new tax law, but uncertain how it will affect their business, dropping from 45 percent in spring 2018. Significantly fewer business leaders (34%) view the potential impact to their bottom line as positive (43% in spring 2018 ). A third (32%) still believe it is too early to tell or simply do not know. Seventy-five percent of business leaders have not made or do not expect to make any changes to their businesses as a result of tax reform, jumping from 61 percent in spring 2018.

Methodology

The PNC Economic Outlook survey was conducted by telephone from 7/9/2018 to 9/13/2018, among small and mid-sized businesses. 503 interviews were conducted nationally. Sampling error for the nationwide results is +/- 4.4% at the 95% confidence level. The survey was conducted by Artemis Strategy Group (www.ArtemisSG.com), a communications strategy research firm specializing in brand positioning and policy issues. The firm, headquartered in Washington D.C., provides communications research and consulting to a range of public and private sector clients.

The PNC Financial Services Group, Inc. (NYSE: PNC) is one of the largest diversified financial services institutions in the United States, organized around its customers and communities for strong relationships and local delivery of retail and business banking including a full range of lending products; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management. For information about PNC, visit www.pnc.com.