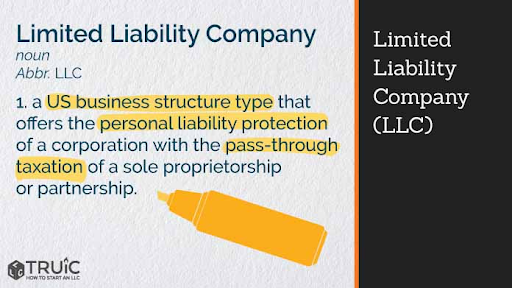

Limited Liability Companies (LLCs) are subject to a number of types of taxation. State tax rates vary based on the business’s location, making it extra important to stay on top of a business’s home state’s forms of taxation so as to avoid misinformation and late filings. The IRS imposes penalties on businesses that both fail to file their taxes and fail to pay their tax bill.

LLC Passthrough Tax by State

Businesses are considered ‘pass-through’ entities if their members are the only parties to foot the tax bill on their independent income tax. Moreover, it occurs when a business, such as an LLC, is not at risk of double taxation, which refers to paying both income and employment taxes for the business and the member’s personal tax return. Unlike corporations, LLCs are only taxed on total profits once – at each member’s individual income tax rate.

Members of an LLC inadvertently choose their self-employment tax when they choose to pay themselves with a distribution from their share of the LLC’s profits.

LLC Franchise Tax by State

The franchise tax is an annual tax allowing businesses to continue to operate in a particular state. The amount of tax that’s due, as well as how it’s counted, varies by state but is a flat rate in the majority of cases. Failure to pay franchise tax can result in a termination of the business.

- Alabama – this tax is referred to as business privilege tax and is based on the LLC’s income from the previous year

- Arkansas – all LLCs pay a flat annual franchise tax of $150

- California – all LLCs pay at least $800 in franchise tax per annum, must pay extra if their returns are greater than $250,000

- Delaware – all LLCs pay a flat annual tax of $300

- Minnesota – multi-member LLCs with greater than $970,000 in combined property, pay and annual sales must pay a partnership tax; all LLCs must file an additional form with Minnesota state to determine the minimum fees

- Nevada – this tax is referred to as Modified Business Tax: it applies to all businesses paying at least $50,000 in wages per quarter

- New Hampshire – two business taxes: Business Profits Tax, which is a flat rate on LLCs with gross income that is greater than $50,000, and the Business Enterprise Tax, which is calculated according to the earnings of each individual business specifically

- Tennessee – Franchise & Excise Taxes are based on an LLC’s net worth and taxable income respectively

- Texas – LLCs with annual revenue exceeding $1,130,000 are obliged to pay a franchise tax along with their annual report

- Vermont – minimum Business Entity Income Tax of $250 is required from all Vermont LLCs

- Washington D.C. – franchise tax is required from all unincorporated businesses with gross receipts exceeding $12,000

LLC Sales Tax by State

This is a tax on physical products that consumers purchase and the state collects. Tax rates are multiplied together with the price of the product and compounded with the final sale. However, some states don’t have sales tax:

- Alaska

- Delaware

- Hawaii

- Montana

- New Hampshire

- Oregon

LLC Gross Receipts Tax by State

Gross Receipts Tax is the commercial equivalent of Sales Tax; it is the method through which businesses pay taxes on products.

States with Gross Receipts Tax

- Delaware

- Hawaii (General Excise Tax)

- Nevada (Commerce Tax)

- New Mexico

- Ohio (Commercial Activity Tax)

- Washington (Business and Occupation Tax)

LLC Employment Tax by State

There are also numerous taxes an LLC is liable to on its employees’ behalf. Some are deducted from employee paychecks and others are paid by the employer (i.e. the owner of the LLC).

The first of these taxes is the Withholding Tax. Employees are required to fill out a form called Form W-4; this allows an employer to calculate the amount of money to deduct from employee paychecks. The money they deduct is then sent to the relevant state department. States with no holding tax include:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

The second is Unemployment Insurance (UI) Tax. This is funded by the owner of the LLC directly; it is paid to state agencies to fund unemployment benefits for eligible workers.

Thus, on top of the taxes that an LLC meaning to pay because of its structure (i.e. S Corp, C Corps and default LLCs), a business must also pay state taxes. If an LLC has employees, it must pay state withholding tax (in the states this exists) plus UI taxes.

If the LLC sells products, they are liable for sales tax (once again, where present), or a gross receipts tax. Finally, some states will add a form of franchise tax on top of this which is either quantified as a percentage of total revenue or as a flat rate.