A new federal tax law lets you deduct car loan interest — but the actual savings may leave many drivers disappointed. The deduction is part of the Trump administration’s One Big Beautiful Bill, and a continuation of President Trump’s efforts to encourage Americans to buy American-made goods.

While any relief is welcome in an auto market with high vehicle prices, high interest rates and inflation, this deduction will not apply to many vehicles currently on dealer lots — even some sold under American brands. Those consumers who do qualify may be surprised by how little the deduction actually saves them.

How to qualify for the car loan tax deduction

The new tax benefit on car loan interest allows you to write off up to $10,000 a year in interest paid on an auto loan for a qualifying vehicle. You can claim the deduction whether you use the standard tax deduction or itemize, but only for purchases made from the beginning of 2025 through the end of 2028.

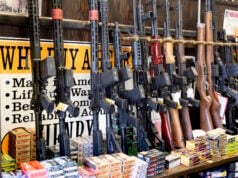

To qualify, you must use a secured auto loan to purchase an eligible vehicle for personal use. Eligible vehicles include most classes of vehicles under 14,000 pounds, including cars, minivans, vans, SUVs, pickup trucks and motorcycles. Recreational and larger vehicles such as ATVs, trailers, campers and RVs do not qualify.

Importantly, whichever vehicle you purchase must undergo final assembly in the United States. You will need to include your car’s VIN on your tax return each year that you claim the deduction.

The maximum annual deduction is $10,000 for taxpayers with a modified adjusted gross income (MAGI) of up to $100,000 ($200,000 for joint filers). The deduction phases out for taxpayers over that threshold.

Disclaimer

The information contained in South Florida Reporter is for general information purposes only.

The South Florida Reporter assumes no responsibility for errors or omissions in the contents of the Service.

In no event shall the South Florida Reporter be liable for any special, direct, indirect, consequential, or incidental damages or any damages whatsoever, whether in an action of contract, negligence or other tort, arising out of or in connection with the use of the Service or the contents of the Service. The Company reserves the right to make additions, deletions, or modifications to the contents of the Service at any time without prior notice.

The Company does not warrant that the Service is free of viruses or other harmful components

This article originally appeared here and was republished with permission.