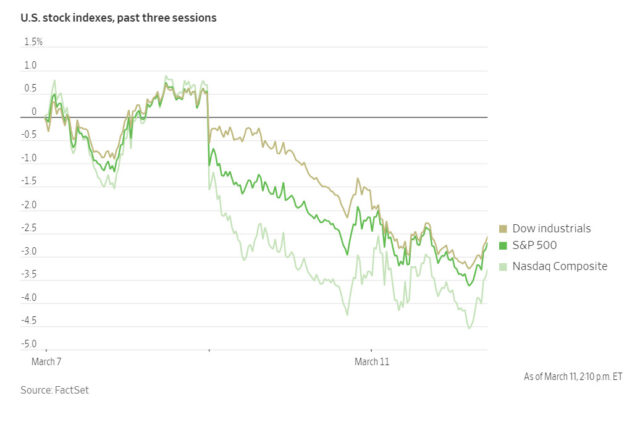

The Dow industrials dropped after President Trump said he would ramp up tariffs on steel and aluminum from Canada to 50%.

Shares of industrial and real estate firms firms were among the biggest decliners in the S&P 500. All 11 sectors in the broad index were trading lower.

Fears about a recession sparked a selloff Monday, with sliding tech shares spurring the Nasdaq Composite’s biggest loss since 2022. President Trump declined to rule out a recession on Sunday and said his economic shake-up would result in a “period of transition.”

“It was a really emotionally charged decline,” said Katie Stockton, founder and managing partner of Fairlead Strategies. But she added that “this is more than just a brief pullback that we’re going through.”

New Labor Department data showed the U.S. had 7.74 million job openings in January, up from 7.51 million in December and slightly above consensus expectations for 7.6 million openings.

On Tuesday, big tech stocks started to recover some of their losses. Tesla shares regained some ground, after the EV maker shed 15% of its market value Monday. Broadcom also rose in afternoon trading.

Verizon stock dropped more than 8% and was the weakest performer of the Dow industrials Tuesday afternoon. A company executive flagged heightened industry competition at an investor conference.

Southwest Airlines led the S&P 500 in gains, alongside CrowdStrike Holdings and Super Micro Computer.

In recent trading:

The Dow industrials, S&P 500 and Nasdaq Composite fell. Monday was the S&P 500’s worst session of the year.

Wall Street’s fear gauge—the Cboe Volatility Index, or VIX—stood at a still-elevated level of about 29.

Airline stocks were volatile after Delta, American, JetBlue and Southwest cut their forecasts amid concerns about travel demand, but Southwest unveiled moves to boost revenue.

Treasury yields hovered around 4.25%, having slipped Monday to 4.21%.

The U.S. dollar weakened further against most major currencies, though it gained against the Canadian dollar following Trump’s latest tariff threat.

The euro strengthened as German conservative leader Friedrich Merz seeks backing for a huge spending plan.

Bitcoin traded at about $81,000, having slipped below $80,000 Monday.

—By Ed Ballard and Owen Tucker-Smith

Disclaimer

The information contained in South Florida Reporter is for general information purposes only.

The South Florida Reporter assumes no responsibility for errors or omissions in the contents of the Service.

In no event shall the South Florida Reporter be liable for any special, direct, indirect, consequential, or incidental damages or any damages whatsoever, whether in an action of contract, negligence or other tort, arising out of or in connection with the use of the Service or the contents of the Service.

The Company reserves the right to make additions, deletions, or modifications to the contents of the Service at any time without prior notice.

The Company does not warrant that the Service is free of viruses or other harmful components