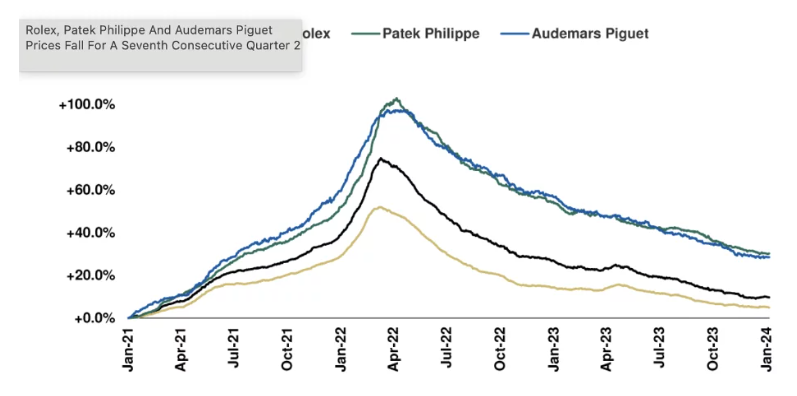

As the luxury watch market has going through a difficult period that saw average prices of the likes of Rolex and Omega’s timepieces decline across the industry in the last 12 months, a glint of sunlight is stirring hopes of its recovery – the cryptocurrency sector’s resurgence.

Specifically, late last year, Business Insider’s Joseph Wilkens observed the “great Rolex recession” was taking place, with the luxury watch market itself declining by 37% since its March 2022 peak and still not fully recovered, according to the ‘Luxury Watch Market Report’ shared with Finbold on March 4.

Indeed, some of the most famous high-end watches are currently selling well below retail, including Rolex with a 68% difference, Audemars Piguet with 66%, and Patek Philippe at 48%, despite the secondary luxury timepiece market being worth around $25 billion.

Meanwhile, the crypto sector has recorded a remarkable rally in the past couple of weeks that has seen its total market capitalization surpass $2.4 trillion, and the flagship decentralized finance (DeFi) asset, Bitcoin (BTC), hit the price threshold at $65,000 with no signs of stopping.

With such massive advances, the wealthy crypto market participants might soon be willing to direct a portion of their new riches into rare timepieces, taking into account the similar trend of some of them becoming new luxury investors in the lead-up to the widespread crypto decline in 2022.

It is also worth noting that the opposite happened during the 2022 crypto crash, which saw an increase in the supply of the most sought-after luxury watches on the second-hand market, putting downward pressure on prices of coveted models, as Finbold reported at the time.

All things considered, in the words of the award-winning watch broker New Bond Street Pawnbrokers, “the return of crypto fortunes could see the supply side of pre-owned luxury watches get a little lighter,” as well as help bring the market back to its former glory and, with it, its prices.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Disclaimer

The information contained in South Florida Reporter is for general information purposes only.

The South Florida Reporter assumes no responsibility for errors or omissions in the contents of the Service.

In no event shall the South Florida Reporter be liable for any special, direct, indirect, consequential, or incidental damages or any damages whatsoever, whether in an action of contract, negligence or other tort, arising out of or in connection with the use of the Service or the contents of the Service. The Company reserves the right to make additions, deletions, or modifications to the contents of the Service at any time without prior notice.

The Company does not warrant that the Service is free of viruses or other harmful components